The 2021 housing market was full of surprises across the board. Low supply and pandemic delays only exacerbated the strong demand for homes, especially in secondary markets. The median price of homes rose exponentially, remarkably so in smaller towns and cities as more people purchased secondary homes or ventured outside of denser urban areas. Understanding last year’s reports can help you make educated choices and cut through the competition in a crowded market. Here are the housing trends we saw in 2021 and what they forecast for 2022; you can use this breakdown to get a sense of what lies ahead and make confident, informed decisions as a buyer or seller.

Home prices skyrocketed in 2021

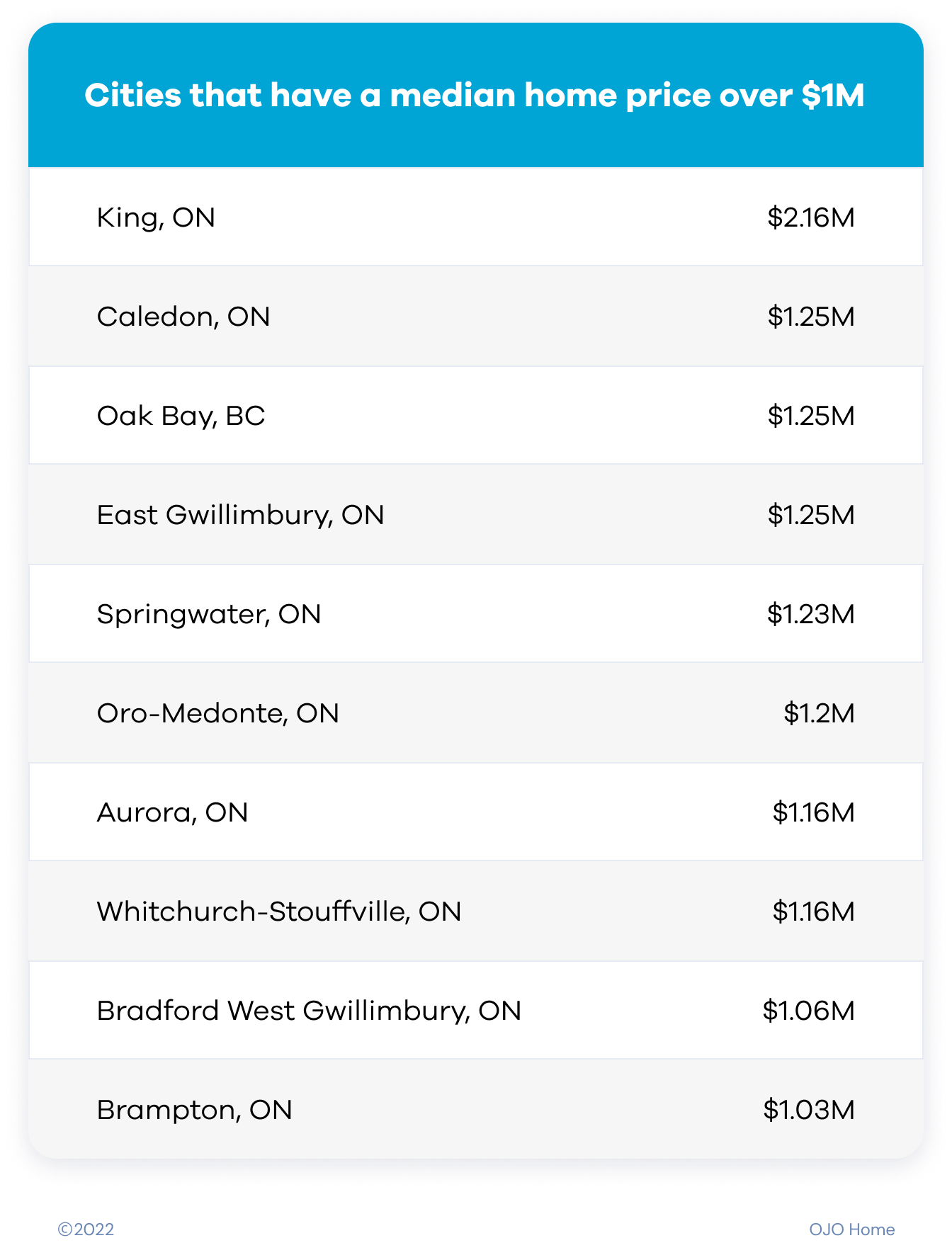

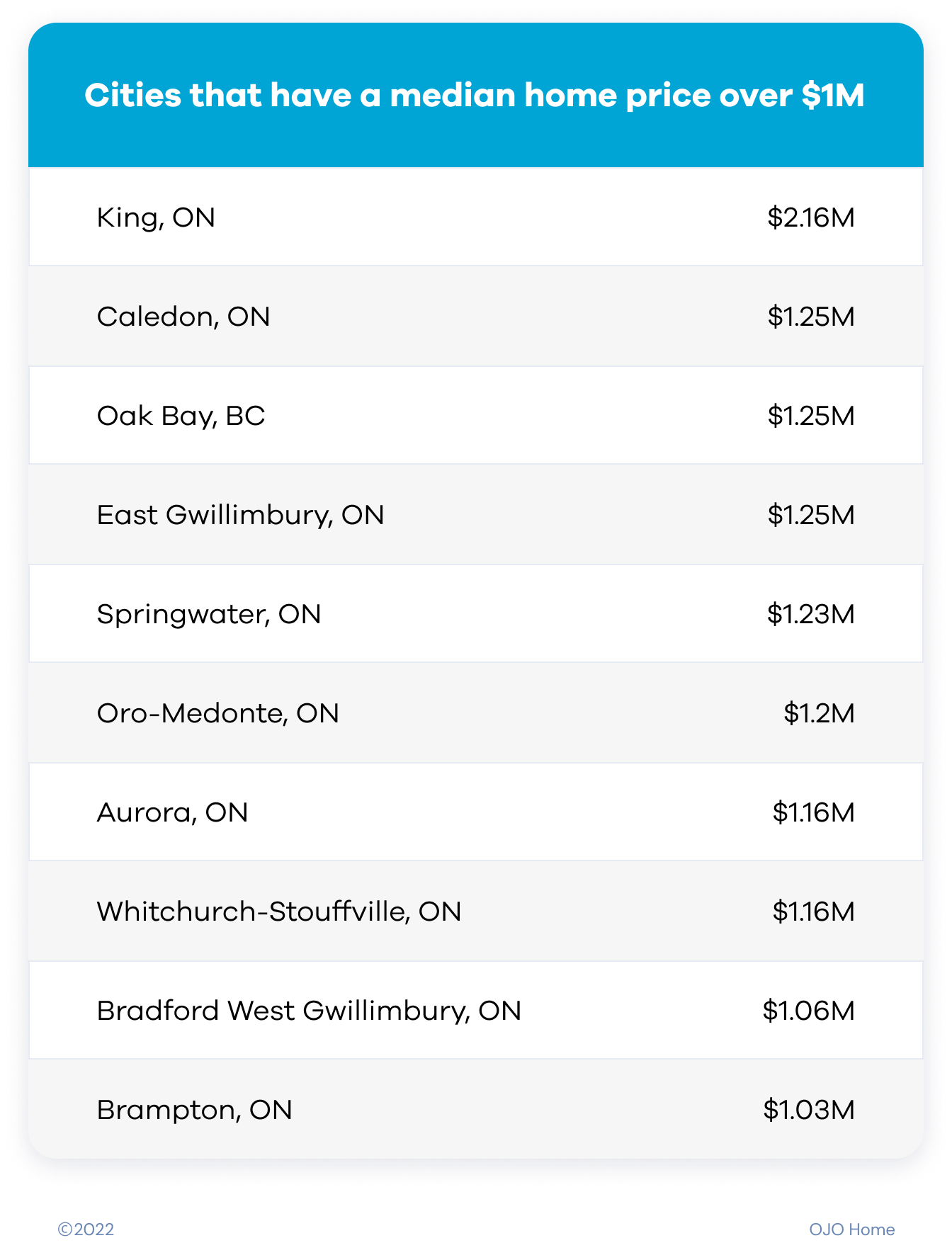

After a tumultuous 2020, even analysts were unsure of what a 2021 real estate market would look like. Pandemic unpredictability created uncertainty about what lay ahead. In the end, the 2021 market defied all expectations and property sales beat Canada’s annual record by Thanksgiving weekend. The combination of low supply, consistent demand, and growing competition steadily drove up prices. Provinces like British Columbia and Ontario saw median price increases over 21%. Even smaller cities like Springwater, Caledon, and East Gwillimbury (Ontario) and Oak Bay (British Columbia) passed the million dollar mark for median home price. In King township just outside of Toronto, the median home price reached a staggering $2.15 million.

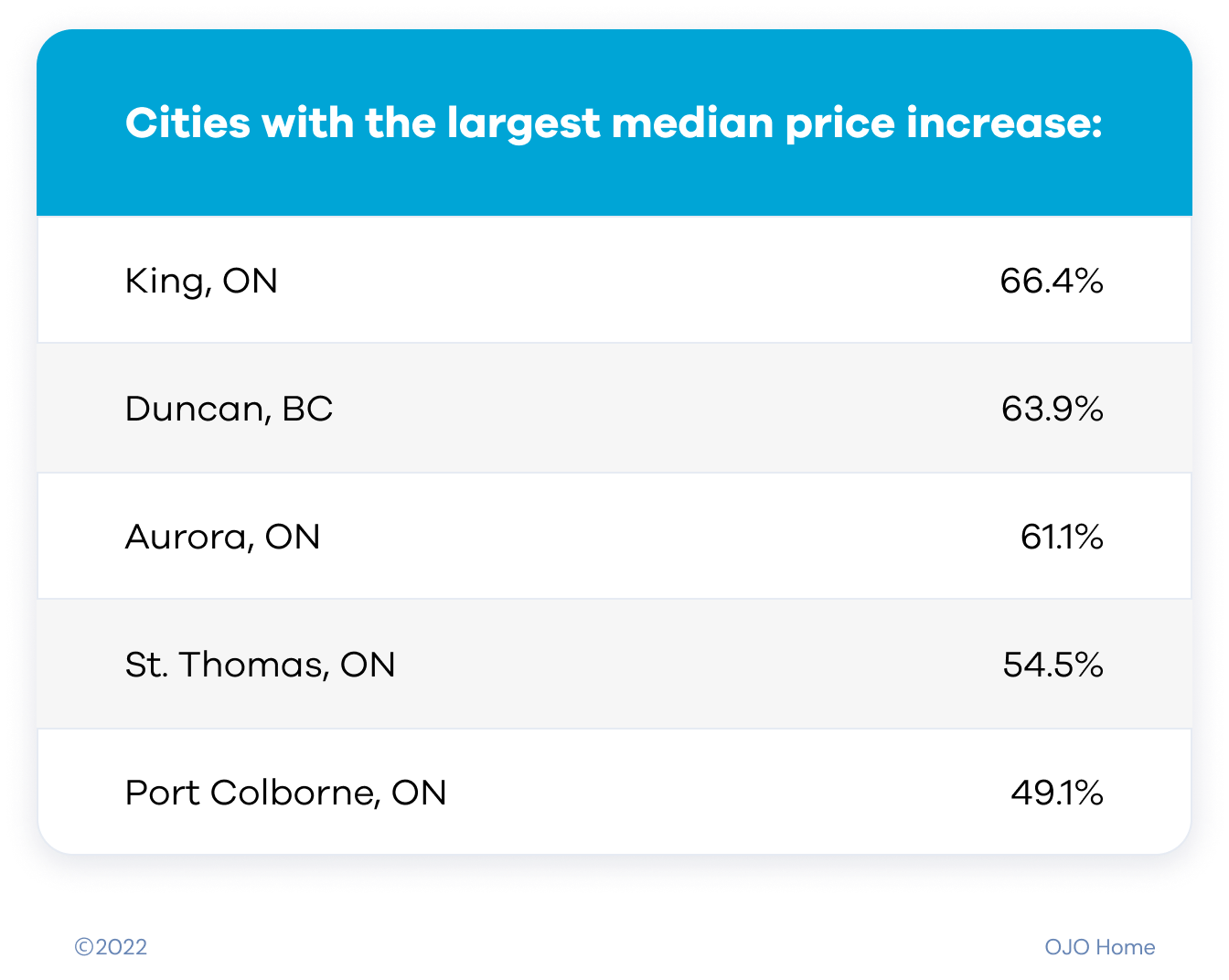

Secondary markets saw the greatest growth

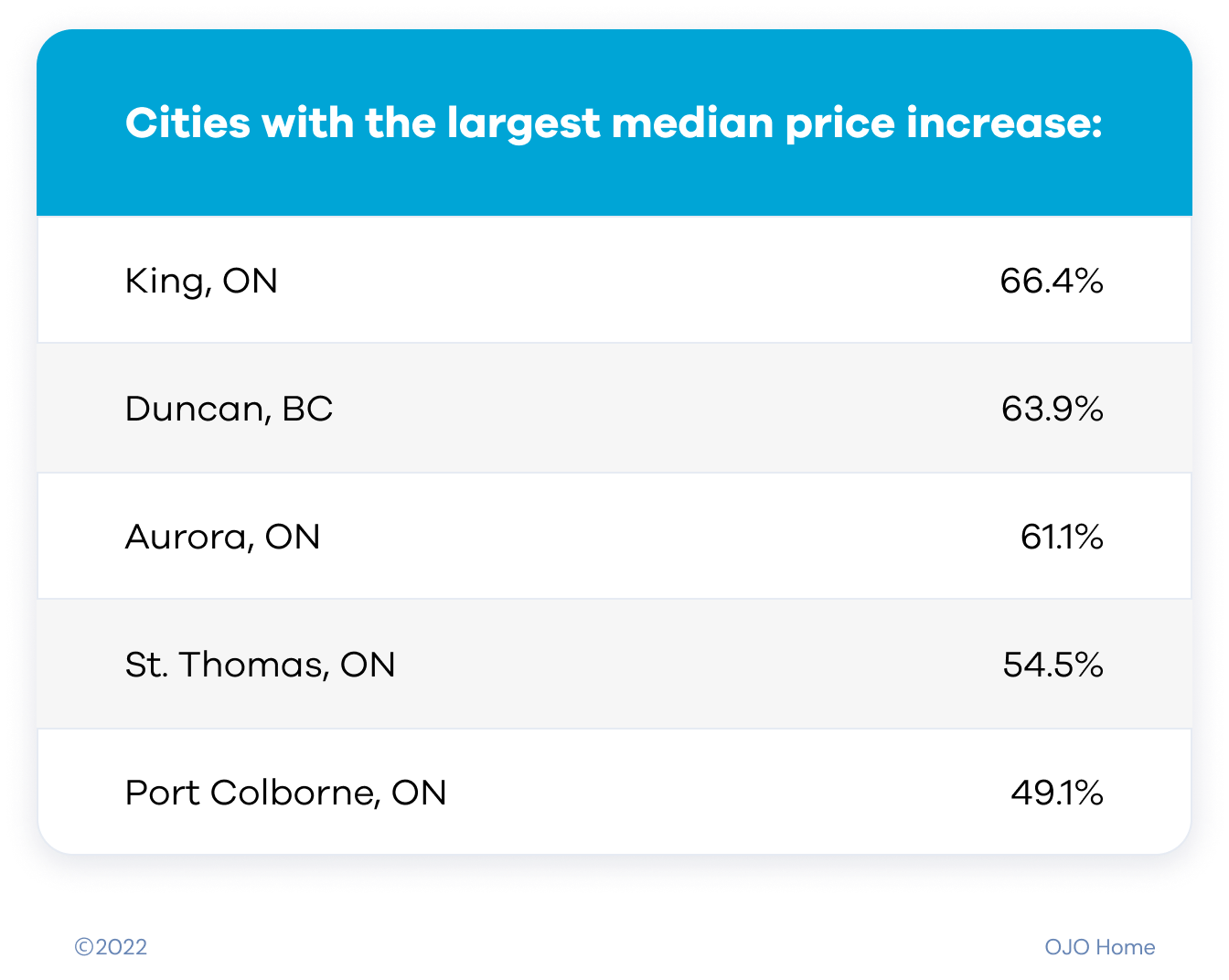

Cities or townships outside of highly urbanized areas saw the largest increase in median home price last year. Homebuyers increasingly sought housing outside of urban centres to find affordable single family homes, a continuation of the migration big cities saw in 2020. Growing demand for affordable homes is likely the driving cause here. Toronto city-dwellers increasingly bought in surrounding townships like King—which saw a 66.4% median price increase—and Aurora, which saw similar growth. Duncan, British Columbia, is the smallest city by area in North America and saw 63.9% median price growth. This ripple effect is also seen outside of smaller cities like London, Ontario, where neighbouring St. Thomas saw a 54.5% median price increase in homes.

Disposable income increased demand

Pandemic life meant less spending on travel, dining, and other experiences, leaving some buyers with a bigger disposable income. Many chose to spend it on real estate. Some of the buyers purchasing homes in smaller cities or suburban secondary markets were city-dwellers leaving urban cores. But many were urbanites looking for second homes outside of the city, as many of these markets are popular for secondary or vacation homes.

Tight supply will continue into 2022

The market responded to low housing supply by investing in new construction and trying to build more homes. However, these plans were often stalled or thwarted by the labour shortages, supply chain issues, permit processing delays, and material shortages that the pandemic exacerbated. Almost 60% of new builds reported supply chain disruptions, with the most significant delays in Ontario. Remarkable growth in demand and price exacerbated tight supply, especially in secondary markets.

Homes sold over asking in 2021

The median price of home sales rose increasingly throughout 2021 across provinces. Ontario saw the highest percentage of homes sold over asking price. There were bidding wars across the country, even in smaller markets that typically see less activity. The most competitive markets based on the homes sold over asking were all secondary markets: Stratford, Ontario; Whitby, Ontario; Kitchener, Ontario; Ajax, Ontario; and Oshawa, Ontario. Homes sold increasingly over asking across provinces, most remarkably in British Columbia, Ontario, and Alberta.

It’s unlikely that a bubble will burst in 2022

Interest rates are expected to go up in marginal increments in the spring of 2022. This could slow rising prices somewhat, and may dissuade some potential buyers. But overall this will be a slow change and it doesn’t mean the bubble will burst anytime soon. Fixed rate mortgages are also on the rise, so these subtle changes will make interest rate hikes inconsequential for most mortgage holders.

Natalka Falcomer, Chief Real Estate Officer at Houseful, emphasizes how these changes might unfold:

“Interest rates going up make it more unaffordable to own a home. However, if interest rates remain reasonable and stay within that stress test range, we may finally see a stabilization in year-over-year growth. This doesn’t mean, however, that prices will stay flat or even reasonable.”

“We’ll continue to see year over year growth, but we won’t be breaking as many year over year growth records.”

We may see less competition and a slowing down of market speed in certain cities and for certain property types like condos, or buildings in secondary markets that don’t have the infrastructure (schools, transportation, grocery stores, and hospitals) to support the recent spike in population. Falcomer also mentions that there’s also the possibility for the “stagnation of prices” or a small price correction in certain cities where employment and infrastructure haven’t quite caught up to the demand for housing.

Single detached homes expected to retain their value

A scarcity of single, detached homes relative to population growth means these homes will retain their value and outpace year over year price increases for condos and townhomes. From 2010 to 2019, Canada’s population grew by 4 million but new single home completions grew by less than 1.1 million. Population growth in prior decades from the 1970s into the 2000s averaged 3 million per decade, with new single family home completions averaging around 1.2 million. Our population growth isn’t being matched by new construction, and pandemic delays and supply shortages have only increased the value of the single family home.

Best practices for homebuying in 2022

Be ready to make fast and informed decisions

Know exactly what you can afford and get pre-qualified and pre-approved early in the homebuying process so you can be strategic in the buying process. Align on your priorities and must-haves so you know exactly what you’re looking for and what you’re able to afford.

Stay informed

Use online reports, articles, and real estate experts to bring context to your homebuying journey. Stay on top of the market and use Houseful blogs as a resource for homebuying checklists, market analysis, and expert advice.

Consider buying early

Interest rates are predicted to rise marginally in the spring, so consider entering the market early. Competition will likely still be high. Be prepared to make a competitive offer and think through your game plan if there’s a bidding war.

Do your research

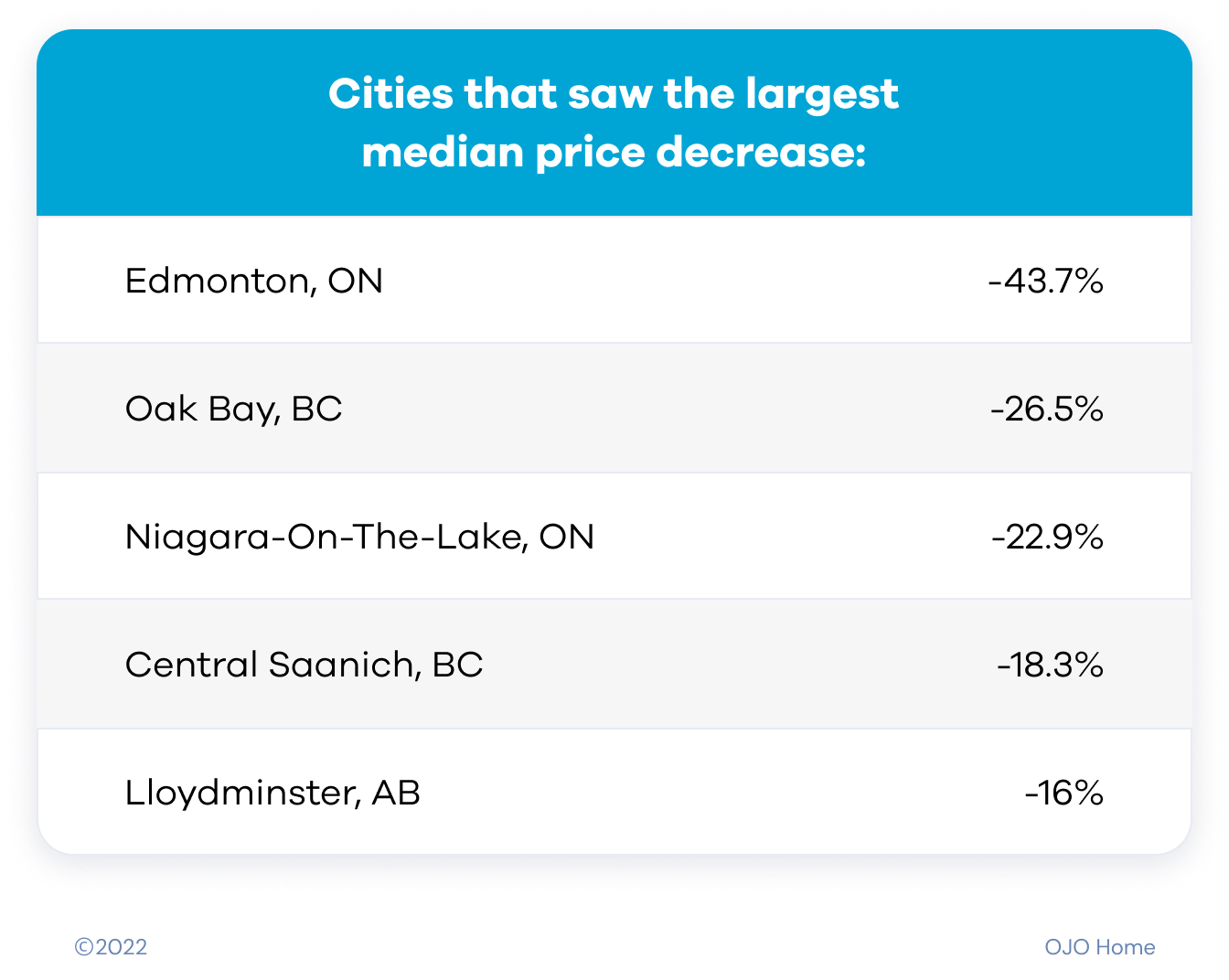

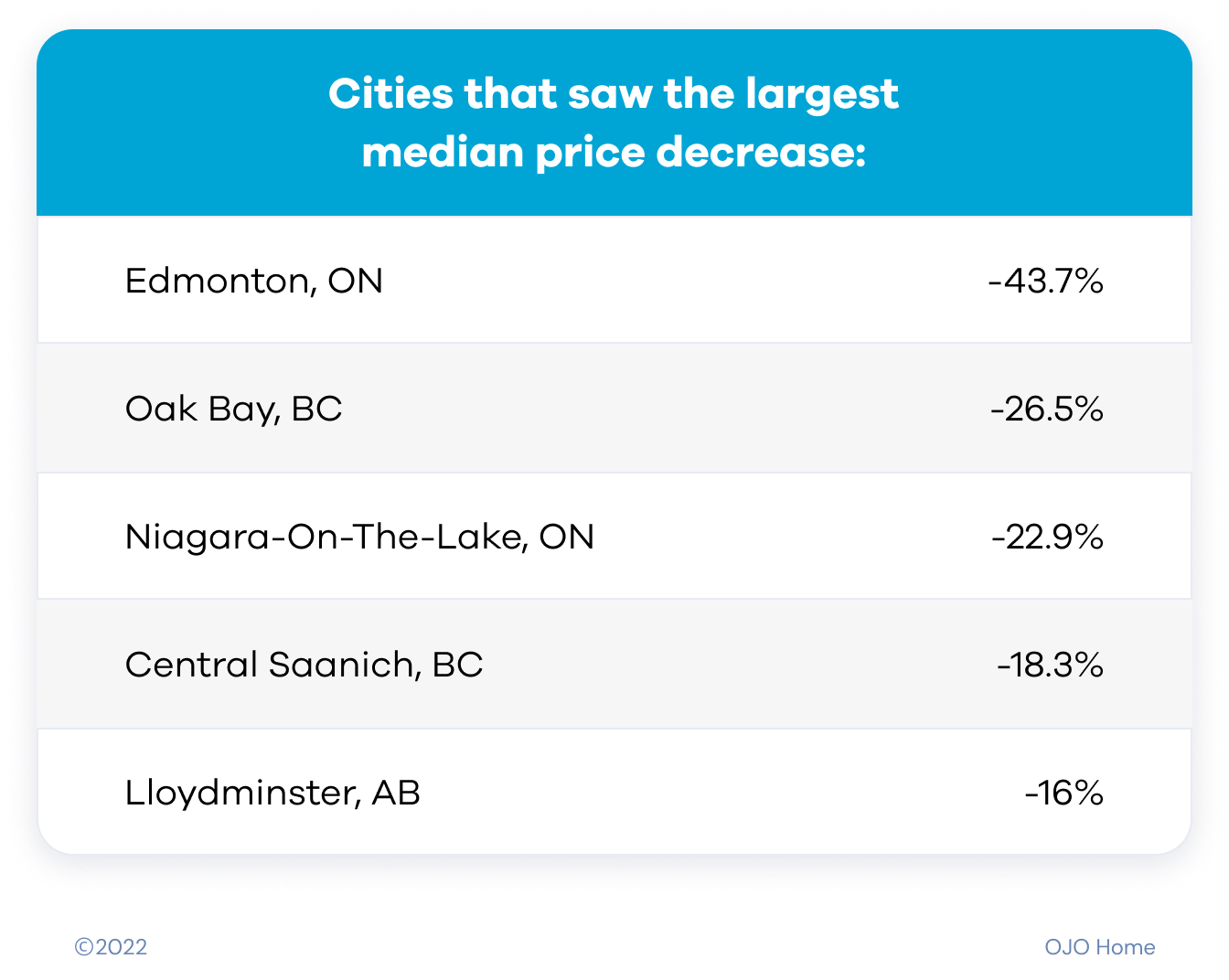

Use market trends and forecasts to help establish where you’ll buy a home. While the vast majority of cities got more expensive, some may be cooling off or becoming more affordable than you thought. Cities that saw the largest decrease in median home price include Edmonton, Oak Bay, Niagara-On-The-Lake, and Lloydminster. Explore homebuying incentives or assistance programs to save on your down payment or your expenses as a first-time buyer.

Market tips for short-term homeowners

- If you’re looking for a “quick flip”, pay close attention to month over month growth, understand who’s buying in the area and if the demand will last in the event of a rate hike.

- Speak with a local real estate professional who knows the area; each market has different fundamentals, and subtleties in local culture and buyer sentiment. The profitability of quick flips are predicated on ever-changing buyer sentiments, so seek advice from someone who understands the area.

- Consider buying a home to use as your primary residence for at least seven years instead of doing a quick house flip. This is always a safer route than a quick flip because you can ride out market fluctuations and focus on year over year growth, handling rate hikes when your mortgage is renewed.

Houseful supports you on your real estate journey.

Houseful helps you navigate the complex homebuying and selling process with a tailored home search experience, professional support, and resources to inform your decisions.

Start Your Home Journey

Find more information on how to buy a home, how to sell your home, and mortgage and finance tips, see our Home Journey How-To’s or sign up at houseful.ca.