If you want to enter the real estate market with confidence, figuring out your budget as a first-time homebuyer is an important first step. How much home you can afford isn’t just about numbers—you should also consider the lifestyle you want to have and your financial comfort levels.

A house you love can quickly become a source of frustration if too much of your income is needed to keep up with the mortgage payments. Take time to clearly outline your boundaries when you’re shopping for a new home so you don’t waste time on a house that doesn’t make financial sense for you. These tips will help you figure out the kind of property you can really afford.

Map out your budget

When you’re setting your homebuying budget, try to think through your current financial situation to decide how much you can reasonably spend. Experts recommend keeping your monthly housing expenses below one-third of your monthly income. To do the math, first figure out how much you make a month. Look at your pay stubs or bank statements to make sure you’re working off of the right number. Then, divide that number by three. For example, if you make $6,000 a month, divide that number by three and you have $2,000 a month for housing expenses.

If you spend more than a third of your income on housing, you may start to feel “house poor”. House poor means that you’re spending so much on your monthly housing costs you have less to spend on other parts of your life.

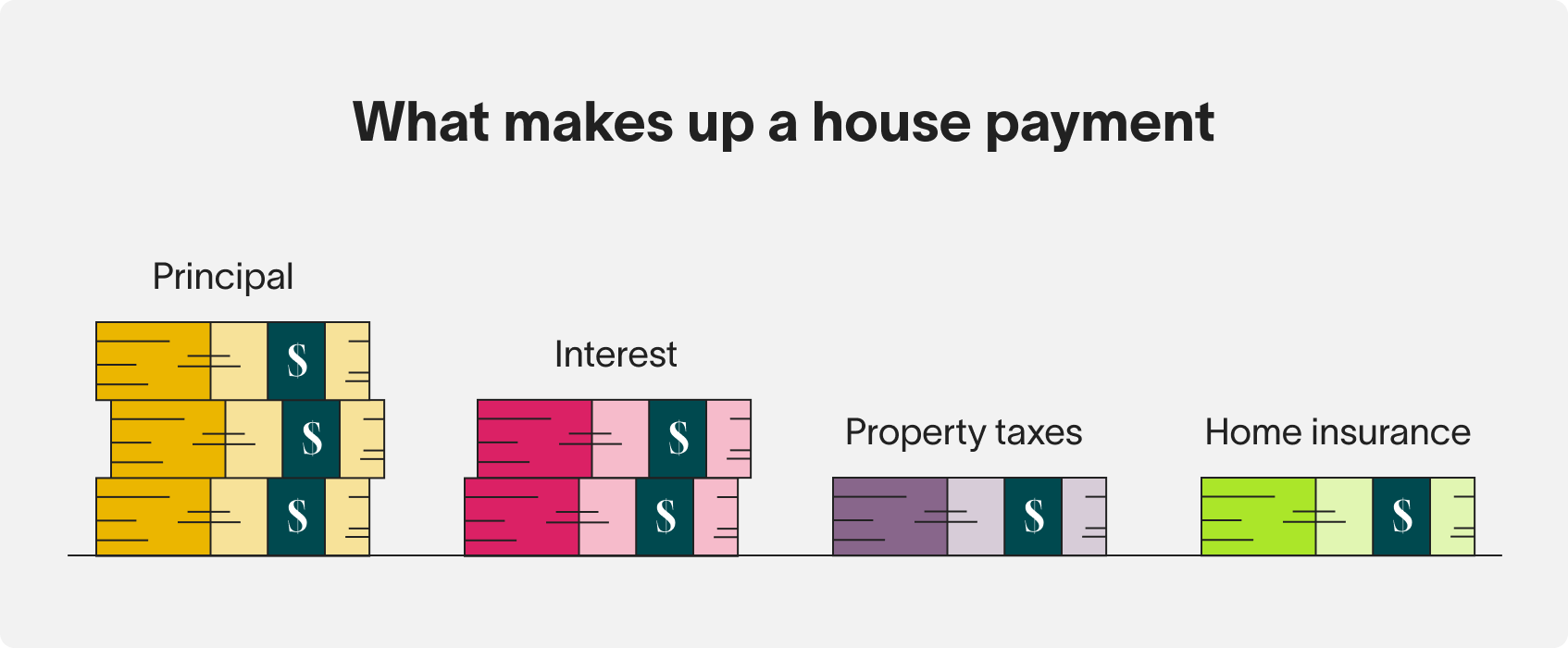

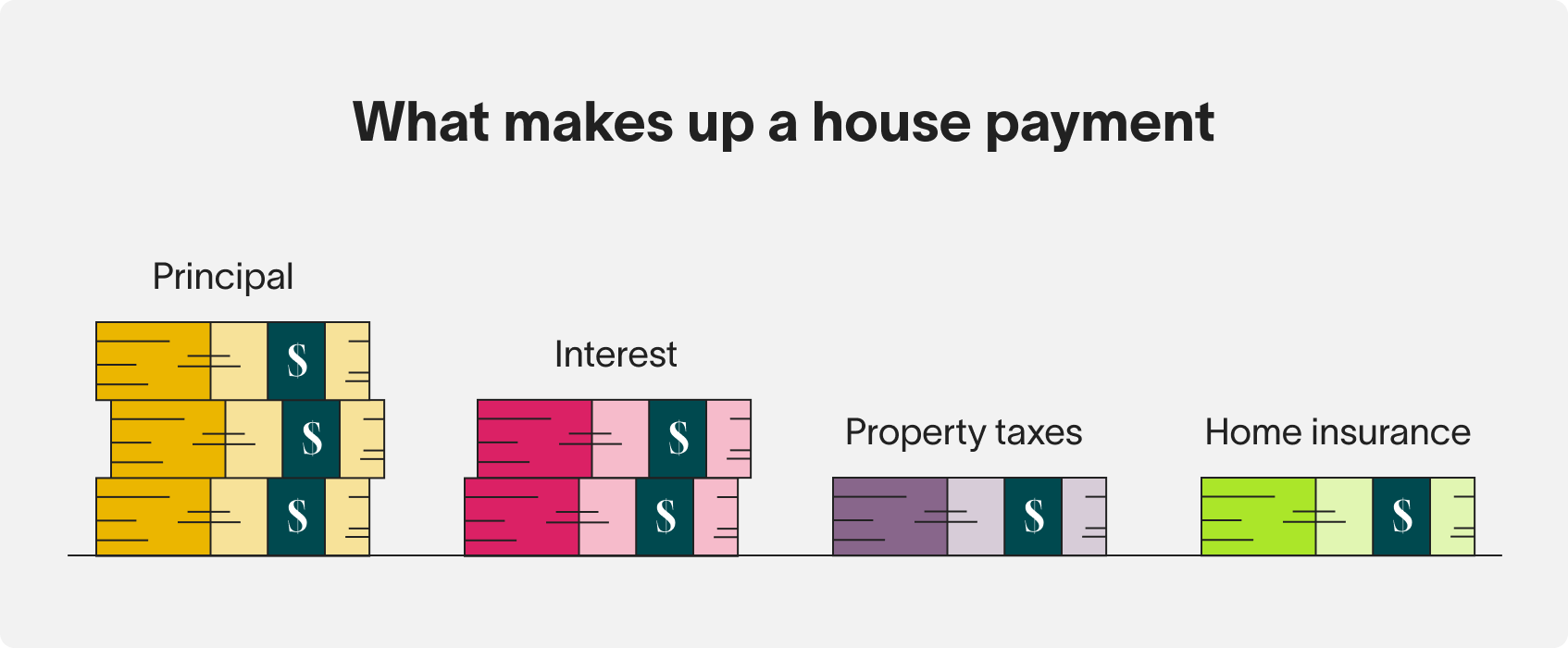

It’s also important to remember how many things factor into your monthly housing expenses. The biggest will be your monthly house payment. Most house payments include four parts: the principal, the interest, property taxes and home insurance.

The principal and interest make up the bulk of the payment. These go toward paying back your initial home loan. The principal is the amount you borrowed, and the interest is the cost of borrowing that money. This part of your house payment will stay the same throughout your mortgage term. Property taxes and homeowner’s insurance are usually bundled into your monthly payment. These may change from year to year, so it’s helpful to leave some room in your budget to cover potential increases. Other monthly costs include utilities, routine home maintenance and any recurring expenses like an HOA or mortgage insurance.

Save for a down payment

Another important factor in determining how much you can afford to spend on a home is your down payment. Most homebuyers mortgage their home. Rather than paying the entire price in cash, they take out a loan with a bank or other financial institution and pay it back over time. The amount you need to pay up-front is your down payment.

The general rule of thumb is a 20% down payment. This means you pay 20% of the home’s total purchase price in cash and borrow the rest. But there are other options.

If the home you’re buying is less than $500,000 you can put down as little as 5% of the purchase price.

For a home in the $500,000 to $1.5 million range, the math gets a little more complicated. You need 5% of the first $500,000, and 10% of the amount left over. For example, the minimum down payment on a $700,000 home would be $45,000–$25,000 for the first $500,000 and $20,000 for the remaining $200,000.

Homes over $1.5 million require a 20% down payment.

The down payment covers a portion of a home’s total cost. It is the initial amount you put down and determines how much you will need to borrow to make up the difference. The more you borrow, the more you need to pay back. The more you need to pay back, the higher your monthly house payment.

When you buy a home with less than 20% down, you’ll also have to pay mortgage insurance until you’ve paid off enough that you have a 20% share in the home.

You can also put more than 20% down and have a lower monthly payment. If and when you eventually sell your home, you take your down payment with you, well as any equity you’ve built. If you sell your home for more than you bought it, you take the extra money with you, too. All of that together can become your down payment on your next home. This is how many people upgrade their housing over time.

There are also Canadian first-time homebuyer benefits and programs that can help you save for a down payment, offset the cost of buying a home or provide benefits when you do.

- A First Home Savings Account (FHSA) is a special type of savings account that allows you to set aside money to use toward a down payment on your first home. FHSAs have a maximum limit of $40,000. In the first year, you can contribute up to $8,000. If you contribute less than $8,000, the difference rolls over into your limit for the following year. The money you contribute to your FHSA is tax-deductible.

- The Home Buyer’s Amount gives eligible individuals a $5,000 non-refundable income tax credit amount on a qualifying home purchased during that tax year.

- The Home Buyer’s Plan (HBP) allows eligible Canadians to withdraw up to $65,000 per year from their registered savings plans (RRSPs) to buy or build a qualifying home for themselves or for a relative with a disability.

- The Canadian Mortgage and Housing Corporation (CMHC), Canadian Guaranty, and Genworth Canada offer assistance for first-time homebuyers who require support in making a down payment.

- Some individuals may qualify for a rebate for part of the GST or HST that you paid to purchase, build, or renovate your new home. Check out the GST/HST New Housing Rebate to learn more.

Understand all the costs

While your down payment is the biggest thing you’ll need to save for, there are other costs that come with buying a home.

At the time of purchase, you’ll need to pay a number of closing costs. Most closing costs are the responsibility of the buyer and are typically between 1.5% and 4% of the purchase price. For example, if you buy a $500,000 home, you can expect the closing cost to be somewhere between $7,500 and $20,000, in addition to your down payment. The amount of closing costs you pay will depend on a number of factors, including how you secure your funding, the province you’re in and whether you’re a first-time buyer.

You’ll also want to consider the cost of moving. This will vary based on the distance you’re moving and the size of your home. If you want to tackle moving on your own, you should factor in the cost of truck or van rental, gas, moving insurance and your time. Hiring professionals will usually cost more, but they will offer a variety of services to choose from, including packing and moving everything on your behalf.

Lastly, factor in the cost of furnishing and decorating your new home. This will largely depend on your personal preferences and tastes as well as the size of the home.The more space you have the greater the need for furniture and decor. $5,000 per room is a standard estimate, but places like second-hand stores and self-assembly furniture retailers will often offer budget-friendly options to lower your costs.

Get pre-qualified or pre-approved

Once you have your personal finances in order, you can work with a lender to understand how much you may be able to borrow.

Pre-qualification

Pre-qualification is best for early in your homebuying journey, while you’re still exploring your options and budget. It involves a lender reviewing your financial information to estimate how much you can borrow. The number the lender provides will be more accurate than the educated guesses you can make on your own. Pre-qualification is free, has no impact on your credit score and has no expiration date. However, it doesn’t guarantee a home loan or specific interest rate down the road.

Pre-approval

You should get pre-approved if you’re ready to purchase in the next 1-3 months. A lender will review your financial information in detail, then provide an offer for how much they are willing to let you borrow and at what interest rate. This offer will usually last for about 90 days.

Keep in mind, your pre-approval letter will reflect the maximum amount you can borrow. The more you borrow, the higher your monthly mortgage payment. Use the budgeting tips mentioned above to decide what’s right for you.

Consider the big picture

With a solid estimate of your purchasing power and an understanding of your limits, you can browse homes with specific numbers in mind. Part of managing your homebuying budget means choosing which features are most important to you and which features you can live without. Some home features may add more to the list price than they actually cost, and sellers will often use visual appeal to their advantage. Things like nice landscaping, high-end appliances and outdoor amenities can lead to a higher price tag. Doing research to figure out how much upgrades would cost if you did them yourself can help you decide if a home’s features are worth the extra money up-front.

Here are some common trade-offs to think about:

Location

Where you choose to live will have a major impact on your lifestyle, so it’s important to consider factors like space, your potential commute and access to amenities like shopping and dining to determine what’s best for you. For instance, a condo near a city-centre may mean a shorter commute and more amenities, but less space. On the other hand, if space is a priority for you, you may want to live in a suburban or rural area.

Property age

Newer homes tend to come with newer appliances and updated interiors. They can also be easier to maintain, though they may cost more upfront than older homes. On the other hand, if you’re interested in purchasing an older home for its character or history, keep in mind maintenance costs tend to be higher and they may lack some modern features.

Home features

When considering how important it is to you to have different home features, such as a big lawn or extra bedrooms, keep in mind they add cost to the price of the home as well as future home maintenance costs. Outdoor features require ongoing maintenance, and more rooms in the house means more spaces to furnish, heat and cool.

Houseful is here for your next steps

From getting your keys to getting back on the market—and all the days in between—Houseful is here to help you keep an eye on the big picture. Let’s see what’s possible and take the next step toward fulfilling your home ownership goals. Visit houseful.ca.